News Centerposition:Baoxingwei > News Center > 正文

Samsung raises $2.2 billion via ASML stake sale for chip investment

Edit:Baoxingwei Technology | Time:2023-08-18 14:22 | Number of views:132

Samsung Electronics Co., the global leader in memory chip manufacturing, has recently divested 3.55 million shares in Dutch chip equipment manufacturer ASML Holding N.V., generating an estimated 3 trillion won ($2.2 billion) in proceeds.

According to Samsung's business report for the first half of the year, this share sale represents a reduction of their stake in ASML from 1.6% in the first quarter to 0.7% in the second quarter.

Back in 2012, Samsung had acquired a 3% stake in ASML for a strategic partnership but has gradually reduced its holdings since then to capitalize on the rising share prices of the Dutch firm.

ASML, the sole provider of chip manufacturing machines utilizing extreme ultraviolet (EUV) scanners and lithography technology, has experienced a significant surge in its stock value on the Nasdaq exchange, driven by expectations of a faster-than-anticipated recovery in the chip industry. In mid-May, the stock reached a one-year high of $735.93. As of Monday's market close, it stood at $666.55.

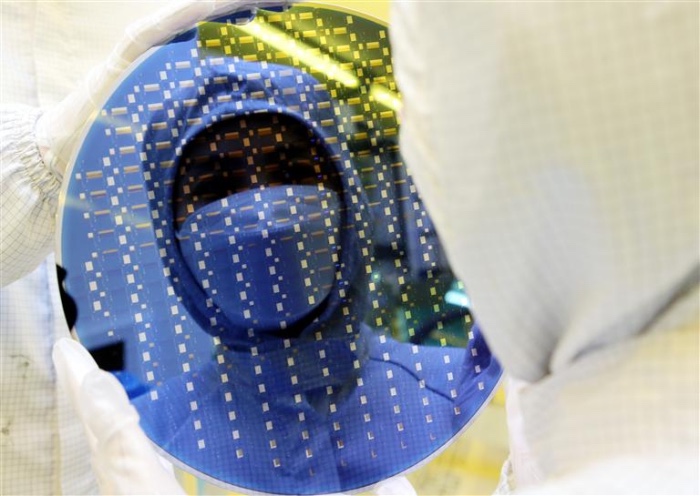

The semiconductor industry heavily relies on cutting-edge equipment like ASML's EUV scanners to produce advanced chips. This is especially crucial for foundries that manufacture chips on behalf of others, including fabless firms and chip designers.

ASML serves as a key supplier to many leading chipmakers, including Taiwan Semiconductor Manufacturing Co. (TSMC), Intel Corp., and SK Hynix Inc.

By raising 3 trillion won from the share sale, Samsung is expected to allocate the funds towards expanding its chipmaking facilities in Korea and internationally, aiming to maintain its competitive edge once the chip market rebounds, according to industry sources.

Samsung has expressed its commitment to continue chip investment even during challenging market conditions. In the first half of the year, the company allocated 90% of its 25.2 trillion won capital expenditures to chip facility expansion and upgrades, signifying a 24% increase compared to the previous year.

Despite posting its lowest operating profit in 14 years and experiencing a 22.3% decline in sales in the second quarter, Samsung remains optimistic about the future of the memory market. The company anticipates a potential rebound as early as the fourth quarter, a sentiment shared by several other leading chipmakers.

Industry officials also suggest that the foundry segment could witness a gradual recovery starting from the current quarter. Hence, Samsung is currently focused on significant investments in expanding its foundry facilities in Pyongtaek, Korea, and a manufacturing plant in Taylor, Texas.

Analysts believe that Samsung's recent sale of its stake in ASML will not have a negative impact on its relationship with the Dutch company. Samsung has been one of ASML's key clients and has made efforts to maintain a strong partnership. Samsung Chairman Jay Y. Lee has personally visited ASML during his trips to Europe, emphasizing the importance of the relationship.

To raise funds for chip investments, Samsung also sold its 1.6% stake in Chinese electric vehicle and battery maker BYD Co. in 2021, generating $1.3 billion.

In addition, Samsung received a record 21.85 trillion won in dividends from its overseas affiliates in the first half of the year, marking a significant increase compared to the previous year. The company has stated that these dividends will be used to expand chip plants both in Korea and internationally.

As of the end of 2022, Samsung held a substantial amount of cash and cash equivalents, with 115.23 trillion won on a consolidated basis and 3.92 trillion won on a standalone basis. This financial strength provides Samsung with the resources needed for its chip investments and expansion plans.

Reference:

Source: KedGlobal

Link: [https://www.kedglobal.com/]

Page Title: [Samsung raises $2.2 billion via ASML stake sale for chip investment]